The Reserve Bank of New Zealand (RBNZ) was founded in The state wholly owns it. The main feature of the bank is tough control over the implementation of goals. In case of failure, the head of the bank may be changed. The committee: the head of the bank When a double top or double bottom chart pattern appears, a trend reversal has begun.. Let’s learn how to identify these chart patterns and trade them. Double Top. A double top is a reversal pattern that is formed after there is an extended move up.. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken Mar 23, · The foreign exchange market (forex) has an average daily trade volume of $5 trillion, making it the largest market in the world. Market participants include forex brokers, hedge funds, retail

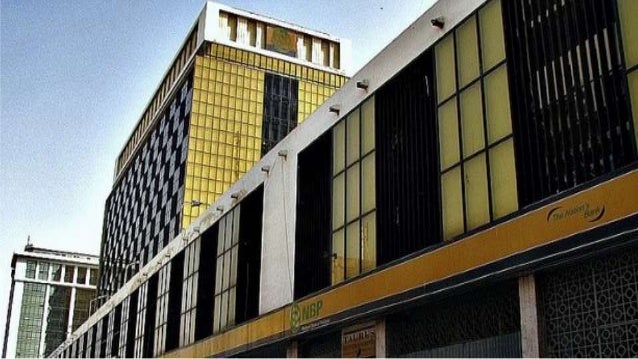

The Foreign Exchange Interbank Market

Every nation or region has a central body that is responsible to oversee its economic and monetary policies and to ensure the financial system relevant bank heads in forex stable. This body is called the central bank. Unlike commercial and investment banks, these institutions aren't market-based and they are not competitive. Many central banks are concerned with inflationwhich is the movement of prices for goods and services.

They keep inflation in line with interest rates. For instance, a central bank will increase interest relevant bank heads in forex when inflation exceeds its target in order to slow growth. Conversely, it lowers interest rates when inflation drops below the bank's target to spur growth. The majority of the world's central banks are independent and answer to their federal governments and, therefore, the general population. This article looks at several of the world's most influential central banks, their mandates, and their structures.

The Federal Reservecommonly referred to as the Fed, is the central bank of the United States. It is probably the most influential central bank in the world. With the U. The Fed is responsible to ensure the U.

economy operates effectively while keeping the best interests of the public in mind. It does this by performing five key functions that promote monetary policyfinancial stability, the soundness of individual financial institutionsthe safety of payment and settlement systems, and consumer protection. The Fed is made up of three distinct groups:.

The European Central Bank ECB was established in The governing council of the ECB is the group that decides on changes to monetary policy. The council consists of six members of the executive board of the ECB, plus the governors of all the national central banks from the 19 eurozone countries.

As a central bank, the ECB does not like surprises. Whenever it plans to change interest rates, it generally gives the market ample notice by warning of an impending move through comments to the press. The bank's mandate is to keep prices stable and ensure that growth is sustainable. The ECB's council meets bi-weekly, but policy decisions are generally made at meetings where there is an accompanying press conference.

These meetings happen 11 times a year. The Bank of England BOE is publicly-owned, which means it reports to the British people through parliament. Founded init is often touted as one of the world's most effective central banks. Its mission is to maintain stability in its monetary and financial systems.

The BOE also ensures:. The bank's monetary policy committee is a nine-member committee that consists of a governor, three deputy governors, a chief economist, and four outside experts.

The Bank of Japan BOJ began operating in This makes inflation the central bank's top focus. The bank's monetary policy committee consists of the governor, two deputy governors, and six other members. dollars and euros. The BOJ is also extremely vocal when it feels concerned about excess currency volatility and strength.

It meets eight times a year. The Swiss National Bank is an independent bank that is responsible for the nation's monetary policy, relevant bank heads in forex. Its main goal is to maintain the stability of prices while overseeing economic conditions in the country. There are two different offices—one in Relevant bank heads in forex and the other in Zurich, relevant bank heads in forex.

Like Japan and the eurozone, Switzerland is also very export -dependent. This means that the SNB does not have an interest in seeing its currency become too strong. Therefore, relevant bank heads in forex, its general bias is to be more conservative with rate hikes. The bank has a three-person committee that makes decisions on interest rates. The bank's committee meets quarterly to ensure the bank is meeting its mandate relevant bank heads in forex. Canada's central bank is called the Bank of Canada.

Its mandate is to ensure stability in Canada's economy and financial system. It accomplishes this by:. It has done a good job of keeping inflation within that range since Monetary policy decisions within the BOC are made by a consensus vote by the governing council, which consists of the bank's governor, the senior deputy governor, and four deputy governors. The executive council, which is made up of the governing council and the chief operating officer COOdrafts the bank's strategic direction.

The Bank of Canada's council meets eight times a year. The Reserve Bank of Australia's functions are set out by the country's Reserve Bank Act The bank's mandate is to ensure its currency is stable, the maintenance of full employmentand the economic prosperity and welfare of the people of Australia.

The RBA's monetary policy committee consists of the central bank governor, the deputy governor, the secretary to the treasurer, and six independent members.

These individuals are appointed by the federal government. New Zealand's economy and monetary policy are overseen by the Reserve Bank of New Zealand RBNZ. The bank is also responsible for sustainable levels of employment along with promoting a sound financial system.

Failure to meet this mid-term target could result in the dismissal of the RBNZ's governor. Unlike other central banks, the decision-making power on monetary policy ultimately rests with the central bank governor.

The list above represents some of the most powerful central banks in the world. Although they may have different targets, structures, and meeting timelines, their mandates are generally relevant bank heads in forex same.

That is to ensure the economic prosperity of their nations, to oversee the financial system, and to control their currencies. These banks often work together to ensure that the global economy remains in check. Board of Governors of the Federal Reserve System. Board of Governors of the Federal Reserve Board. European Central Bank. Bank of England, relevant bank heads in forex. Bank of Japan. Swiss National Bank. Bank of Canada.

Reserve Bank of Australia. Reserve Bank of New Zealand. Federal Reserve. European Central Bank ECB. Monetary Policy. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Basic Forex Overview. Key Forex Concepts. Currency Markets. Advanced Forex Trading Strategies and Concepts.

Table of Contents Expand. What Is a Central Bank? Federal Reserve Relevant bank heads in forex Fed. Bank of England BOE, relevant bank heads in forex. Bank of Japan BOJ. Swiss National Bank SNB.

Bank of Canada BOC. Reserve Bank of Australia—RBA. Reserve Bank of New Zealand—RBNZ. The Bottom Line. Key Takeaways Central banks are responsible for economic and monetary policy and they make sure the soundness of the financial system.

These institutions set interest rates and control the money supply of a country. The U. Federal Reserve is one of the most powerful central banks in the world.

The European Central Bank oversees the policies of the eurozone. Other notable central banks include the Bank of England, the Bank of Japan, the Swiss National Bank, the Bank of Canada, and the Reserve Banks of Australia and New Zealand.

3 Apps Every Forex Trader Needs To Be Successful

, time: 14:35Forex Bank levels alert indicator | Projectreaper Team (Official Dev Blog)

Apr 06, · Ok guys this is another alert indicator I made for bank levels trading strategy we are trading break outs or pull backs. What is bank levels – this is previous day high / low, previous week high / low and previous month high / low price level Mar 23, · The foreign exchange market (forex) has an average daily trade volume of $5 trillion, making it the largest market in the world. Market participants include forex brokers, hedge funds, retail Most common forex trading strategy – example how to do big banks trade forex. Step 1. Accumulation Example. Like we said, Accumulation is the first step of the market in the bank trading system. Smart money trading without accumulation may not allow banks to take any position in any currency blogger.comted Reading Time: 7 mins

No comments:

Post a Comment