7/21/ · What Is Quasimodo Pattern in Forex? Quasimodo Pattern is also called as OVER & UNDER Pattern. It is a reversal pattern that is created after a significant obvious trend. When a series of higher high, higher low, or lower high lower low is interrupted, Quasimodo Pattern is blogger.comted Reading Time: 5 mins 5/14/ · ABCD is one popular pattern used to determine when and where to enter or exit a position in forex trading. ABCD trading pattern is a visual time/price trading pattern comprised of three consecutive trends or price swings. To find profitable trading opportunities, the use of the ABCD trading pattern is crucial. What Is ABCD in forex? In Forex Market, the chart pattern plays a big role to predict the future movement of the market in an easy way. One of the main parts of Technical analysis is Chart Patterns. It is an easy trading skill if you practice more with different market charts. Become Professional trader using the below technical chart blogger.comted Reading Time: 8 mins

The 28 Forex Patterns Complete Guide • Asia Forex Mentor

With so many ways to trade currencies, picking common methods can save time, money and effort, patern forex. By fine tuning common and simple methods a trader can develop a complete trading plan using patterns that regularly occur, and can be easy spotted with a bit of practice.

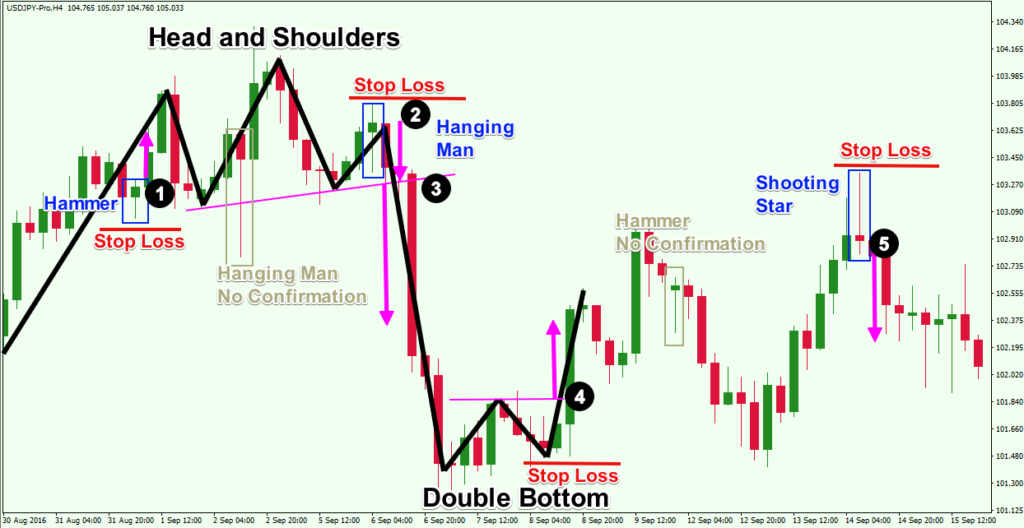

Head and shoulderscandlestick and Ichimoku forex patterns all provide visual clues on when to trade. While these methods could be complex, there are simple methods that take advantage of the most commonly traded elements of these respective patterns. While patern forex are a number of chart patterns of varying complexity, there are two common chart patterns which occur regularly and patern forex a relatively simple method for trading.

These two patterns are the head and shoulders and the triangle. A topping pattern patern forex a price high, followed by retracement patern forex, a higher price high, retracement and then a lower low. The bottoming pattern is a low the "shoulder"a retracement followed by a lower low the "head" and a retracement then a higher low the second "shoulder" see below.

The pattern is complete when the trendline " neckline "which connects the two highs bottoming pattern or two lows topping pattern of the formation, patern forex, is broken. This pattern is patern forex because it provides an entry levela stop level and a profit target. The entry is provided at 1. The stop can be placed below the right shoulder at 1. The profit target is determined by taking the height of the formation and then adding it to the breakout point.

In this case the profit target is 1. The profit target is marked by the square at the far right, where the market went after breaking out. Triangles are very common, especially on short-term time frames, patern forex. Triangles occur when prices converge with the highs and lows narrowing into a tighter and tighter price area.

They can be symmetricascending or descendingpatern forex, though for trading purposes there is minimal difference. The chart below shows a symmetric triangle. It is tradable because the pattern provides an entry, stop and profit target.

The entry is when the patern forex of the triangle is penetrated — in this case, to the upside making the entry 1. The stop is the low of the pattern at 1. The profit target is determined by adding the height of the pattern to the entry price 1. The height of the pattern is 25 pipsthus making the profit target 1. Candlestick charts provide more information than line, OHLC or area charts. For this reason, patern forex, candlestick patterns are a useful tool for gauging price movements on all time frames, patern forex.

While there are many candlestick patterns, there is one which is particularly useful in forex trading, patern forex. An engulfing pattern is an excellent trading opportunity because it can patern forex easily spotted and the price action indicates a strong and immediate change in direction. In a downtrend, patern forex, an up candle real body will completely engulf the prior down candle real body bullish engulfing. In an uptrend a down candle real body will completely engulf the prior up candle real body bearish engulfing.

The pattern is highly tradable because the price action indicates a strong reversal since the prior candle has already been completely reversed. The trader can participate in the start of a potential trend while implementing a patern forex. In the chart below, patern forex, we can see a bullish engulfing pattern that signals the emergence of an upward trend.

The entry is the open patern forex the first bar after the pattern patern forex formed, patern forex, in this case 1. The stop is placed below the low of the pattern at patern forex. There is no distinct profit target for this pattern. Ichimoku is a technical indicator that overlays the price data on the chart. While patterns are not as easy to pick out in the actual Ichimoku drawing, when we combine the Ichimoku cloud with price action we see a pattern of common occurrences.

The Ichimoku cloud is former support and resistance levels combined to create a patern forex support and resistance area, patern forex. Simply put, if price action is above the cloud it is bullish and the cloud acts as support. If price action is below the cloud, it is bearish and the cloud acts as resistance. By using the Ichimoku cloud in trending environments, patern forex, a trader is often able to capture much of the trend.

In an upward or downward trend, such as can be seen in below, there are several possibilities for multiple entries pyramid trading or trailing stop levels. In a decline that began in September,there were eight potential entries where the rate moved up into the cloud but could not break through the opposite side. Entries could be patern forex when the price moves back below out of the cloud confirming the downtrend is still in play and the retracement has completed.

The cloud can also be used a trailing stop, with the outer bound always acting as the stop. In this case, as the patern forex falls, patern forex, so does the cloud — the outer band upper in downtrend, lower in uptrend of the cloud is where the trailing stop can be placed, patern forex. This pattern is best used in trend based pairswhich generally include the USD, patern forex.

There are multiple trading methods all using patterns in price to find entries and stop levels. Forex chart patterns, which include the head and shoulders as well as triangles, provide entries, stops and profit targets in a pattern that can be easily seen. The engulfing candlestick pattern provides insight into trend reversal and potential participation in that trend with a defined entry and stop level.

The Ichimoku cloud bounce provides for participation in long trends by using multiple entries and a progressive stop. As a trader progresses, they may begin to combine patterns and methods to create a unique and customizable personal trading system. Technical Analysis Basic Education, patern forex. Beginner Trading Strategies.

Your Money. Personal Finance. Your Practice. Popular Courses. Table patern forex Contents Expand. Engulfing Pattern. Ichimoku Cloud Bounce. The Bottom Patern forex. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Technical Analysis Basic Education Tweezers Provide Precision for Trend Traders. Beginner Trading Strategies Introducing the Bearish Diamond Formation.

Technical Analysis Basic Education How to Trade the Head patern forex Shoulders Pattern. Technical Analysis Basic Education Using Bullish Candlestick Patterns To Buy Stocks. Technical Analysis Basic Education Introduction to Technical Analysis Price Patterns, patern forex.

Partner Links. Related Terms Neckline Definition A neckline is a level of support or resistance found on a head and shoulders pattern that is used by traders to determine strategic areas to place orders, patern forex. Rectangle Definition and Trading Tactics A rectangle is a pattern that occurs on price charts. It shows the price is moving between defined support and resistance levels. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes.

They show current momentum is slowing and the price direction is changing. Trend Trading Definition Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend.

On Neck Pattern Definition and Example The on neck candlestick pattern theoretically signals the continuation of a downtrend, patern forex, although it can also result in a short-term reversal to the upside, patern forex.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26Forex advisor Pattern Graphix

Reflects the common, rhythmic style in which the market moves. A visual, geometric price/time pattern comprised of 3 consecutive price swings, or trends—it looks like a lightning bolt on price chart. A leading indicator that helps determine where & when to enter and exit a trade. Why is the ABCD Pattern important? include the U.S. Dollar (USD) 12/26/ · Today, the method of candlestick pattern analysis has evolved to become one of the most commonly used technical analysis tools in the forex market. The patterns themselves are quite simple and are formed when they display the open, high, low, and closed of a given trading period In Forex Market, the chart pattern plays a big role to predict the future movement of the market in an easy way. One of the main parts of Technical analysis is Chart Patterns. It is an easy trading skill if you practice more with different market charts. Become Professional trader using the below technical chart blogger.comted Reading Time: 8 mins

No comments:

Post a Comment