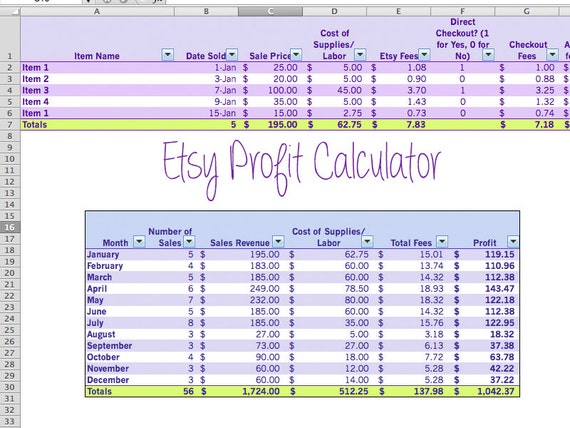

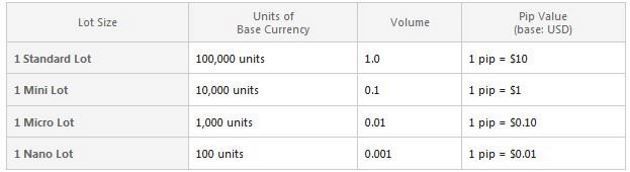

For example; you start with $1, and risk 3% of your account or $ You make $ in profits and your account is now worth $1, For the next trade you risk 3% again, but this time that 3% is worth $ If however, the first trade lost and you lost $30 (3%), your account would be worth $ and the next trade risking 3% would be risking $Estimated Reading Time: 5 mins 4/4/ · Let us calculate your profits. There is a simple formula for this: 1 pip in the decimal form / the current exchange rate of the quote currency to the US Dollar = value per blogger.comted Reading Time: 3 mins The transaction size is , Euros. To calculate your profit or loss, you take the selling price of $, subtract the buying price of $ and multiply the difference by the transaction size of , ($ – ) X , = $ In this example, you

FOREX Pip Calculation | Profit and Loss - P/L Calculation

We also have no idea if what others is doing is actually working. Profits and losses can very often be deceptive and in this quick guide we will go through the most accurate way to work out profit how to compute forex profitability loss and how to stay away from being deceived. The large issue with pips is that they can often be deceiving and not give you the true picture of whether you are making money or not. As a trader, you should know that pips do not actually determine if you are profitable or not.

You cannot eat pips and you cannot buy anything with pips. You can buy things with money. At the end of the day, week and month you need to know whether you are winning or losing in cold hard cash because that how to compute forex profitability what you have deposited into your trading account and is that is what you will be withdrawing. Pips do not show that you are making any real profit.

You can be positive many pips, but losing a lot of real dollars. On the flip side, a trader can still make a profit, even if their pips how to compute forex profitability is negative — and that is the key. For this reason, traders should stop figuring out profit and loss in pips and instead in money.

The first step to doing this is to work out your trade position size before each and every trade. Having the same trade size amount on every trade does not mean you are risking the same amount of money on every trade. This a common mistake made by novice traders. Stop size can drastically change on each trade. If you have a 20 pip stop on a 1 hour chart and a pip stop on the weekly chart, then the loss of the trade on the weekly trade is 10 times the size of the loss of a 1 hour chart if trading the same Forex pair.

The Forex pair and market can also change the amount at risk by an incredible amount. That is the reason why you should think about dollars and not in pips. If trade sizing gets out of hand and gets too large, then all market analysis would be deemed worthless. For that reason, you should always discipline yourself to risk the same percentage of your trading account on each and every trade. Then, how to compute forex profitability, the only thing that will change each trade is your stop size.

Determining how big the trade amount you need to put on depends on how big or small your stop size is and the market traded. No matter how big the stop loss is in pips, you will still be risking the same percentage of your account every trade. This will normally mean different amounts will be entered into each trade. One of the most common methods of working out risk per trade is by using the fixed percentage method, how to compute forex profitability.

This means that no matter what the pair or stop size, you are willing to risk the same percentage of your total trading account capital each trade. On the first trade you are trading with a 30 pip stop and then on a second trade you have a pip stop.

On the flip side, if you lose you would now be risking less, how to compute forex profitability. There are many of them and they are as easy as filling out the fields and getting the answers you need. You can find a position size calculator from Babypips here.

Before filling out the calculator you will need to know your base currency currency of your trading accountcurrent trading account balance, how much in percentage you want to risk, how large your stop loss will be and the pair you are trading. Important Note: After selecting your currency pair the calculator will often ask you for a current price.

This will often not be the pair you are trading and it is incredibly important you add the price that the calculator asks for.

Thinking in terms of money and not pips is crucial for knowing where exactly you are as a trader. As traders we need to know if we are making profits and cold hard cash. We also need to know that when we put on our next trade it will not be so large that it may blow our whole account, or so small that it will not cover any losses. Your Guide to Price Action Entries FREE PDF Download.

How to find, enter and place stop losses on the best price action entries. If you are new to Forex, then learning how to read a price action chart can be incredibly confusing. How to compute forex profitability am using all aspects of technical analysis and price action in my trading with a goal to help you learn to do the same.

Skip to content. Table of Contents. Featured Brokers Overall Rating Trade Now. Overall Rating Trade Now. Investagal If you are new to Forex, how to compute forex profitability, then learning how to read a price action chart can be incredibly confusing.

CALCULATING RISK - FOREX TRADING - How to Calculate Lot Size

, time: 5:45Calculate Forex Trading Profit and Loss: Quick Guide

6/25/ · The actual profit or loss will be equal to the position size multiplied by the pip movement. Let's look at an example: Assume that you have a , GBP/USD position currently trading at Tick size is the smallest possible change in price. Pip value for direct rates are calculated according to the following formula: Formula: Pip = lot size x tick size. Example for , GBP/USD contract: 1 pip = , (lot size) x (tick size) = $ USD. Calculating Direct Rate P/L (Profit/Loss) Calculating P/L for direct rates is VIEW ALL DEVICES. START MINING WITH NICEHASH. *Please note that values are only estimates based on past performance - real values can be lower or higher. Exchange rate of

No comments:

Post a Comment