A managed account is one that is owned by an investor or institution but is overseen by a professional money manager. The money manager is granted access to the account and makes pertinent decisions in alliance with the client’s goals and objectives. In forex managed accounts, the manager makes trading decisions in line with the client’s risk tolerance, capital value, and his expected goals. How it Estimated Reading Time: 10 mins 6/21/ · overtrade your account. So, here's the money management system: 1. Create a seperate account or subaccount just for your scalp trades. 2. Only scalp pairs with LOW spread (EUR/USD and USD/JPY come to mind) 3. Choose a proper risk factor. You can go with 20 pips = 1% of your account, or if you want to be agressive, 10 pips = 1% of your account. 4 Money management in trading currencies should be a key part of a forex trader’s overall risk management strategy. As the name implies, forex money management involves consistently using one or more strategic techniques to make a currency trader’s risk capital yield the highest return for any losses that might be incurred in the blogger.comted Reading Time: 12 mins

Forex Money Management Tips for Beginner Traders - My Trading Skills

If you want to become a successful trader, you must follow good Forex money management rules. Money management refers to a set of tools, techniques and practices, used by market participants, that aim to increase profitability and reduce the overall risk of losing money in the market. Traders and investors use money management rules to keep track of the performance of their trading accounts.

Money management should be a part of a well-round trading planwhich in addition to money management rules also includes your trading strategy, market approach, entry and exit triggers and forex money management plan for a 10 account asset classes to trade, forex money management plan for a 10 account. While money management is extremely important in trading, bear in mind that it only reflects one part of your general trading plan.

Anticipating future price-moves correctly is only one side of a coin. For example. On the other side, a trader with a mediocre trading strategy who knows how to manage his trades and money will likely end up with a better trading result simply by cutting his losers short and letting his winners run.

Opening extremely large position sizes is one of the major reasons why beginner traders blow their first trading account in record time. This is why controlling your potential losses and trading risks plays such an important role in trading. Check Out: What to Include in Your Trading Journal Spreadsheet. Balance — The balance of your account reflects your total account size without unrealised profits and losses of your running trades. Equity — Your equity reflects your account size adjusted by any unrealised profits and losses of your running trades.

Your free margin will then equal your Equity minus your Used Margin. Position Size — The position size refers to the total market exposure of a trade. Risk-per-trade is usually expressed as a percentage of your trading account.

This ratio equals the potential profit on a trade divided by the potential loss on a trade. This trade would have a reward-to-risk ratio ofi. your potential profit is three times larger than your potential loss. Expert tip. At some point, all of us had the temptation to chase the market for a trade setup, forex money management plan for a 10 account, especially after closing a trade in loss.

Stop-loss orders play a vital role in Forex money management. They help you to quantify your losses and to avoid letting them out of control.

Forex money management plan for a 10 account trading, there are four main types of stop loss orders:. a Chart Stops — This type of stop-loss orders is based on important technical levels in a price-chart.

Most of the time, chart stops return the best results. b Volatility Stops — Volatility stops are used to close your trade once the traded financial instrument reaches a pre-determined volatility level. c Equity Stops — Equity stops use a pre-determined amount of money, usually as a percentage of your trading account, to set your stop-loss levels. d Time Stops — As their name suggests, time stops are used to close your trades by the end of the London trading session, end of the trading day or end of the trading week, to give a few examples.

To boost your trading performance, I strongly recommend to use chart stops and to adjust your position size according to your risk-per-trade. This is a crucial point in money management, the importance of which many traders realise too late, forex money management plan for a 10 account.

You should always adjust your forex money management plan for a 10 account size according to your stop-loss level, and not the other way around as in the case of Equity Stops. For currency pairs that trade at four decimal places e. For currency pairs that trade at two decimal places e. Cut Your Losses Short and Let Your Profits Run.

Successful traders are extremely impatient with losing trades and let their winning trades run. While trades based on bad setups should be closed as soon as possible, make sure to give enough breathing room for good setups to perform. There is a high chance that even good setups will be in loss at some time before picking up the right direction.

Read: Awesome Tips to Improve Your Trading Mindset. However, after a few trades and with some experience, your money management rules will become second nature to you. Money management needs to be an integral part of your overall trading plan. You should follow your money management rules in each trade you open in order to maximise your gains and minimise your losses. While there is no single best Forex money management system, certain rules and practices have shown to work great to increase your trading performance.

However, bear in mind that all rules need to be fine-tuned to fit into your psychological traits, risk tolerance and trading style. You need to find what fits you the best. Use chart stops and adjust your position size accordingly. Chart stops are based on important technical levels on the chart, such as support and resistance levels, which increases their efficiency. Once you determine your stop-loss size, adjust your position size to remain inside preferred risk-per-trade.

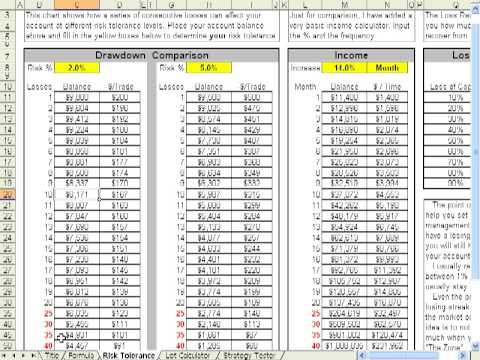

Set Up a Money Management Spreadsheet. Last but not least, make sure to forex money management plan for a 10 account a money management spreadsheet with all the vital information of your money management rules.

Money management refers to a set of rules and practices that aim to reduce your losses and increase your profits in the market. Make sure to create and follow your money management rules as soon as possible to keep your risk under control — Your bottom line will be thankful for that, forex money management plan for a 10 account. So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK?

Then this…. Day trading is one of the most popular trading styles in the Forex market. However, becoming a successful day trader involves a lot of blood,….

Want to day trade for a living? Most new and inexperienced forex money management plan for a 10 account would like to start trading with a small trading account, and brokers have carefully listened. Most brokers have lifted their…. Becoming a full-time trader with consistent profits forex money management plan for a 10 account financial freedom and being your own boss. Next: Step 2 of 4.

Phillip Konchar February 11, We've just launched My Broker Consultationit is a free, zero obligation, service designed to help you find your ideal broker and secure you a trading rebate cashback.

Put simply, I wish I had access to a service like this when I started. Phillip Konchar - Head Tutor. Categories: Skills. Phillip Konchar. Related Articles. Joe Bailey October 8, Phillip Konchar June 2, Joe Bailey September 29, Joe Bailey October 26, Joe Bailey October 23, Request a Free Broker Consultation. Phone including intl. If you are human, leave this field blank. Information you provide via this form will be shared with Forest Park FX only as per our Privacy Policy.

MEMBERS ONLY The My Trading Skills Community is a social network, charting package and information hub for traders. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not.

Buy community. Any person acting on this information does so entirely at their own risk. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Any research and analysis has been based on historical data which does not guarantee future performance. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Losses can exceed your deposits and you may be required to make further payments. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice.

Historical data does not guarantee future performance. I Understand. Then please Log in here. Not registered yet? Sign up here. Amount Necessary to Return to Initial Balance.

Forex Money Management, Best Forex Money Management System, Forex Money Management Strategy

, time: 11:03Top 5 Best Forex Managed Accounts for - MyFinAssets

9/30/ · In the first sheet you select the currency pair, enter account type, planned TP and SL in pips, your money balance, price and number of lots you plan to trade. The amounts for tp and stop-loss as well as the percent of balance are calculated. There is one sheet called currencies which collects the latest currency values. This must be manually updated Money management in trading currencies should be a key part of a forex trader’s overall risk management strategy. As the name implies, forex money management involves consistently using one or more strategic techniques to make a currency trader’s risk capital yield the highest return for any losses that might be incurred in the blogger.comted Reading Time: 12 mins A managed account is one that is owned by an investor or institution but is overseen by a professional money manager. The money manager is granted access to the account and makes pertinent decisions in alliance with the client’s goals and objectives. In forex managed accounts, the manager makes trading decisions in line with the client’s risk tolerance, capital value, and his expected goals. How it Estimated Reading Time: 10 mins

No comments:

Post a Comment