Apr 19, · Candlestick patterns. As we mentioned earlier, technical traders believe the patterns made by candlesticks can help you make trading decisions. They tell you where sentiment on a market might be headed, which you can use to predict where price will go next. Bullish patterns are taken as a sign that an upward move is imminent Dec 07, · Candlestick formations and price patterns are used by traders as entry and exit points in the market. Forex candlesticks individually form candle Author: David Bradfield Mar 26, · Good Morning, To become a successful Forex trader, you need to learn about price action trading and candlestick patterns. This involves analysing a candlestick chart that reflects the actions and beliefs of every market participant – both human and computer programs – as influenced by current events, market demands, and other essential deciding factors

8 Essential Forex Candlestick Patterns in Trading | CMC Markets

Forex candlestick patterns are a form of charting analysis used by forex traders to identify potential trading opportunities. This is based on historical price data and trends.

When used in conjunction with other forms of technical and fundamental analysis, forex candlestick patterns can offer valuable insight into possible trend reversals, breakouts and continuations in the forex market. Japanese candlesticks were first invented in Japan in the 18th century and have been used in the western world as a method of analysing the financial markets for well over a century.

In particular, they are commonly used for forex trading. They rely on past price action to forecast future price movements. Forex candlestick patterns are fairly visual compared to other forms of technical analysis and offer information on open, high, low and close prices for the financial instrument you wish to trade.

Forex candlesticks are especially useful in offering insight into the short-term price movements of the markets, making them a valuable tool for forex day trading strategies. In a typical Japanese candlestick charteach candlestick represents the open, high, low and close prices of a given time period for a currency pair.

The formation of a candlestick requires the open, high, low and close prices of a specific period. For example, a trader would need the daily, open, forex candle stick patterns kiyala, high, low and close price to generate a daily candlestick. This would be the same for either a weekly or monthly candlestick. For the candlestick to be successfully evaluated, you would need to wait for the closing price of a session.

The body of the candlestick indicates the difference between the opening and closing prices for the day. Candlesticks are generally coloured, as it makes it easier to see whether the candlestick is bullish or bearish. The body of the candlestick is hollow, and the areas above and below the body are called shadows, forex candle stick patterns kiyala. Candlestick reversal patterns in forex can help traders to identify trend reversals, breakouts and continuations when monitoring currency pairs.

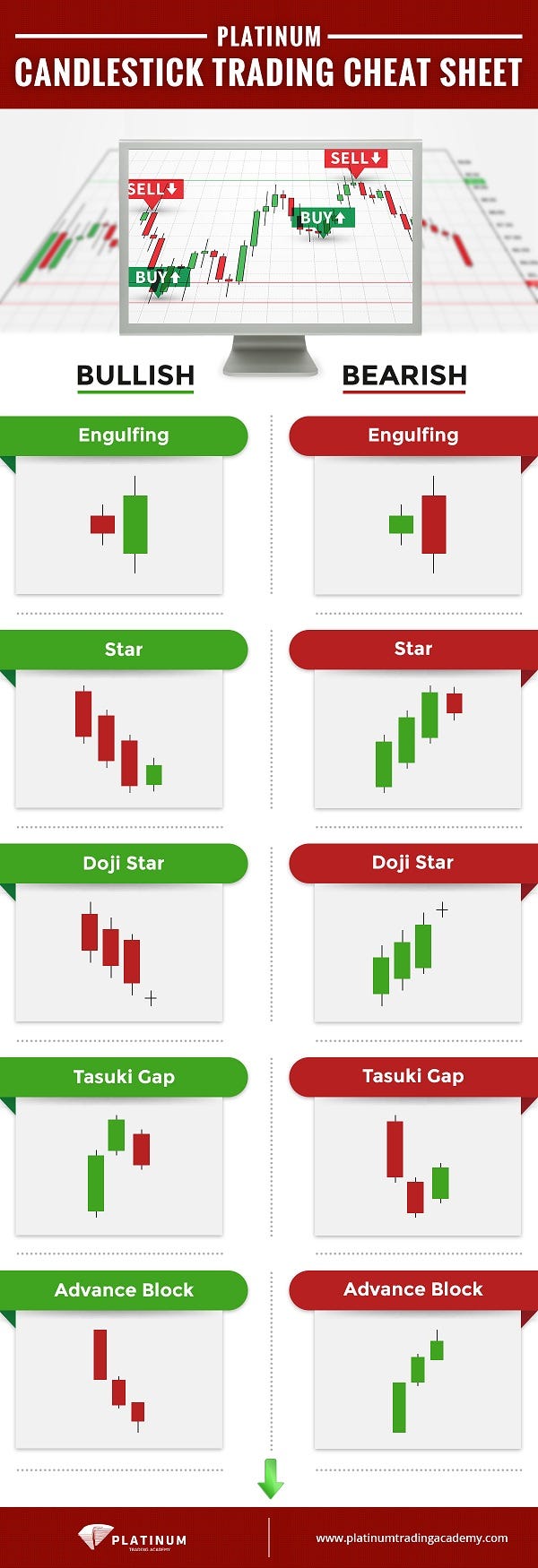

This provides signals for traders to modify their positions, short sell or add extra stop-losses in order to avoid capital loss. Technical analysis is used to determine uptrends and downtrends within the FX market, by drawing support lines on candlestick graphs. There are over 40 recognised forex candlestick forex candle stick patterns kiyala patterns in total. Below is a list of eight of the best candlestick patterns to spot in forex trading:.

Black marubozus are significant candlestick patterns that give valuable insight into selling pressure. Black marubozus are rectangular candlesticks with little or no shadow at the top or bottom. These indicate selling pressure in a market and show that bears were calling the shots from the opening bell until the closing bell on the day.

A marubozu trading strategy is especially valuable for significant support and resistance levels and may indicate that a potential price level is about to be hit.

White marubozus are similar to their black counterparts, but they indicate that prices are being controlled by buying pressure. These are rectangular blocks with very little or virtually no shadows at the top or bottom. White marubozus most commonly indicate continuation in an uptrend, while in a downtrend they can indicate that a potential trend reversal could occur. Doji, or crosses, are usually made up of a single candlestick and they show that the opening and closing price of a candlestick is virtually the same.

In technical analysis, dojis usually represent neutrality, meaning that the trend is likely to continue. The shadows or wicks on a doji are an important indicator of market sentiment. For example, if the shadow at the top of the candlestick is long, it means that investors tried to push the price higher, but failed, while a longer shadow at the bottom indicates the presence of selling pressure.

The larger the size of the engulfing candlestick, the more significant it is to analysts. A black engulfing candlestick represents a potential bearish reversal during an uptrend, forex candle stick patterns kiyala, while a white engulfing candlestick could indicate that a bullish reversal is about to occur in a downtrend.

A common bullish reversal pattern, hammers indicate that an uptrend is likely to occur. As the name suggests, hammer candlesticks have a short body, with a shadow or wick that is twice as long at the bottom. When the high and close are the same, it indicates the formation of a bullish candlestick pattern, meaning that while bears tried to push prices lower, buying pressure from the bulls pushed up prices, with prices eventually closing at the same level as the day's high.

Hammers candlestick patterns where the open is the same as the high are considered less bullish, but indicate a possible bullish trend nevertheless. Shooting stars look a lot like inverted hammers from above and indicate that a bearish reversal is about to occur. Shooting star candlesticks are created when the low, forex candle stick patterns kiyala, open and close of the day are close to each other, with the day's high located high above, forming at least twice the length of the body of the candlestick.

When the low and closing prices are the same, a shooting star is considered more significant as it indicates that bulls tried to push prices higher but were overpowered by the bears, and prices eventually closed at a similar level to where they opened.

Shooting star candlestick chart patterns can sometimes look like a gravestone doji. Three-line strikes usually occur at the end of a downtrend and may, therefore, indicate that a reversal might be in order, forex candle stick patterns kiyala. Three-black crows are a common reversal forex indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day.

Formed of three consecutive black candlesticks with long bodies, these indicate the lack of buying conviction in the market, which allowed bears to successfully push prices lower. Evening star candlestick forex candle stick patterns kiyala usually occur at the top of an uptrend and signify that a trend reversal is about to occur. Evening stars consist of three candlesticks, with the first candlestick having a significantly large green or white body, indicating forex candle stick patterns kiyala prices closed higher than the opening level.

The second candlestick forex candle stick patterns kiyala higher after a gap, meaning that there is continued buying pressure in the market. The second candlestick in an evening star pattern is usually small, with prices closing lower than the opening level. The third and final evening star candlestick opens lower after a gap and signifies that selling pressure reversed gains from the first day's opening levels. When used in conjunction with other forms of analysis, candlestick patterns can be a useful indicator of potential trend reversals and price breakouts in the market, helping you to build forex candle stick patterns kiyala stronger and more effective forex trading strategy.

So, what are the risks of trading with a forex candlestick patterns strategy? When trading the financial markets, you are constantly exposed to market risk. While trading following patterns and studies, traders should always be aware of the potential risk of algorithmic trading. This uses information at the speed of light and can alter the landscape at any time using data that might not be available to the trader.

Therefore, it is important that you consider risk management prior to entering any trades, forex candle stick patterns kiyala. Similar to other systems of trading, forex candle stick patterns kiyala will need to have an idea of where to stop out and where to take profits before you enter a trade.

We also recommend that forex traders take stop-loss orders into consideration, as trading with leverage can maximise profits, but can equally maximises losses.

Seamlessly open and close trades, track your progress and set up alerts. Our award-winning trading platformNext Generation, comes with a wide range of Japanese candlestick patterns that traders are able to draw on, customise and use to improve their trading strategy within the forex market. Take a look at our new charting features here. Drawing tools, technical indicators and price projection tools are also available for traders on-the-go with our mobile trading app.

This applies to forex candle stick patterns kiyala Android and iOS users, so you can start perfecting your forex candlestick pattern strategy straight away.

Disclaimer: CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any forex candle stick patterns kiyala investment, security, transaction or investment strategy is suitable for any specific person, forex candle stick patterns kiyala.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, forex candle stick patterns kiyala, we do not seek to take advantage of the material prior to its dissemination. See why serious traders choose CMC. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Personal Institutional Group. Australia English 简体中文. Canada English 简体中文. New Zealand English 简体中文, forex candle stick patterns kiyala. Singapore English 简体中文. United Kingdom.

International English 简体中文. Start trading. Products Ways you can trade CFDs Spread betting What you can trade Forex Indices Cryptocurrencies Commodities Shares Share baskets Treasuries ETF trading Product details CFD spreads and commissions CFD margins CFD other costs CFD rebates. Latest news Economic calendar Highlights Featured chart Our market analysts Michael Hewson David Madden.

Learn CFD trading What are CFDs? Advantages of trading CFDs Risks of CFD trading CFD trading examples CFD holding costs Learn cryptocurrencies What is bitcoin? What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. Help topics Getting started FAQs Account applications FAQs Funding and withdrawals FAQs Platform FAQs Product FAQs Charges FAQs Complaints FAQs Security FAQs Glossary Contact us FAQs How can I reset my password?

How do I fund my account? How do I place a trade? Do you offer a demo account? How can I switch accounts? CFD login. Log in. Home Learn Trading guides Forex candlestick patterns. Forex candlestick patterns Forex candlestick patterns are a form of charting analysis used by forex traders to identify potential trading opportunities. See inside our platform. Get tight spreads, no hidden fees and access to 11, instruments.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26Forex Candlesticks: A Complete Guide for Forex Traders

Dec 07, · Candlestick formations and price patterns are used by traders as entry and exit points in the market. Forex candlesticks individually form candle Author: David Bradfield Mar 26, · Good Morning, To become a successful Forex trader, you need to learn about price action trading and candlestick patterns. This involves analysing a candlestick chart that reflects the actions and beliefs of every market participant – both human and computer programs – as influenced by current events, market demands, and other essential deciding factors Apr 19, · Candlestick patterns. As we mentioned earlier, technical traders believe the patterns made by candlesticks can help you make trading decisions. They tell you where sentiment on a market might be headed, which you can use to predict where price will go next. Bullish patterns are taken as a sign that an upward move is imminent

No comments:

Post a Comment