10/20/ · The best forex broker for most people is definitely blogger.com or IG. Currency trading, or forex. is the process of exchanging one currency for another Estimated Reading Time: 8 mins 6/25/ · For a long period, we professionally research the Forex automated trading market. Over the years, we have gained experience that we systematically share with you in our reviews. Choosing an EA is a very important procedure, as it involves using it on a real account in order to make money. In the table, we have put together the ratings and results of the best trading robots blogger.comted Reading Time: 6 mins Trade stocks on overseas exchanges and attach an FX order to the equity trade to hedge the currency you want at the time of trade. Large-Size Order Facility 1 Large-Sized Order quotes are specific to the order quantity entered are generated based upon an aggregation of quotes provided by interbank dealers to help get the best execution possible and minimize market impact

Best Forex Robots | Top Fx EA

Mainly we focus on daily time frame forex trading strategy. Why is that? Because trading daily best ib forex for daily trade is not as exciting as trading lower time frames such as Minutes or 5-Minutes. It is boring and it has fewer trading opportunities. But did you know that trading on the daily chart will allow you to execute higher profitable trades which often leads to consistent profits? Not only that but also the daily chart helps us to improve areas such as trading psychology, trading discipline and patience.

Read this article about How trading Daily Chart Can Help You Improve Your Trading. on that article, we listed 9 ways trading daily chart help us to become better forex traders. Today in this article we are going to talk about 3 profitable daily time frame forex trading strategies, best ib forex for daily trade.

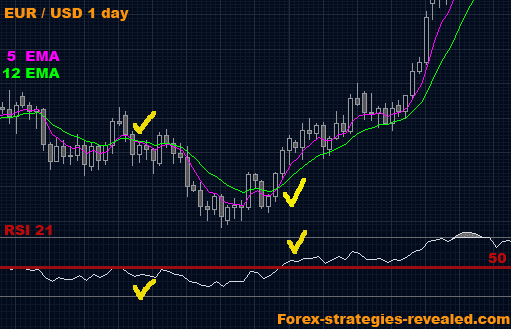

This is true as long as the trend keeps going up or down. But the trend is not going forever, at some point it has to reverse and this is where lots of trend traders got caught up. The point here is, You need to have a set of rule to both identifying on-going trends and trend reversals to trade while minimizing the trading losses. We use Period EMA to find trend direction — If price trading above the Period EMA, It is a general uptrend and If price trading below the Period EMA, It is a general downtrend.

We use Period EMA and 9-Period EMA to find dynamic support and resistance best ib forex for daily trade During an uptrend, the area between Period EMA and 9-Period EMA work as dynamic support and during a downtrend, the area between two moving average work as a dynamic resistance.

We are going to use price actions as our entry trigger and we are going to talk about how to place stop-loss and take profits correctly. Price is making lower lows, best ib forex for daily trade, moving averages are pointing down and above all, the price is bouncing off from dynamic resistance level twice Have a look at the blue box marked in the chart.

Above factors confirm that we have a healthy downtrend, best ib forex for daily trade. Now we have to look for a way to go short.

But how? We have to wait for a pullback to dynamic resistance, this is where we have an edge in the downtrend, right? Now best ib forex for daily trade a look at the chart above. Where is the price right now? At the dynamic resistance, right? This is exactly what we need. Our next job is to place the trade, for that we need a confirmation to go short. We can use price action for this matter. Have you noticed any price action pattern here? If you can spot a bearish engulfing pattern, great.

This is our entry trigger. Now all confluences are aligned nicely, best ib forex for daily trade, Now it is a matter of placing the trade. We can place a sell order here. But where we place stops and targets. According to the above chart, we placed stop-loss a few pips above the lower high, And we used 2R for the target which means our take-profit is twice as the stop-loss. Beside the stop-loss and take best ib forex for daily trade, we have to manage the trade, right? This is simple.

Learn more on How to Cut Losses in Forex, best ib forex for daily trade. Have a look at the two examples that we executed in the last month before move into the next trading strategy. Support and resistance are one of the highly rated and most profitable trading tools when it comes to anticipating market movements. Almost every trading strategies out there use some sort of support and resistance. Another fact about support and resistance is that they tend to works better on higher time frames especially in the daily chart.

Which mean price has to be test support or resistance in the near past. Have look at the 4-Hour gold chart below. According to the above chart, you can see that there is a level comes from the daily chart which acts as a resistance in past. But on the 4-hour we can see that price again bounce from that daily resistance level and this confirms this resistance is valid and can look for trades in future.

Just like that before looking for any trades we have to confirm the validity of the support and resistance. So what are the confirmations that we can use to find the price movement around support or resistance?

Have a look at the marked bullish engulfing candlestick pattern in the above chart. Why this candle is important for us? There are two reasons, one is Bullish engulfing pattern indicate buying pressure and the second one is it occurred at daily support level which is a higher probability area to look for trade opportunities.

With all these confluences in mind, we place stop-loss few pips below the bullish engulfing pattern and we use 2R for the take profit. Just like that, you can also use the pin bar as your entry technique. Have a look at the chart below. Read our Ultimate Guide to the RSI indicator to learn more about the RSI Indicator. Before that keep in mind RSI over-bought and over-sold is not trading signals, But if you can combining RSI over-bought and over-sold with price actions, then you can have a small edge over the market.

Have a look at the chart below, first, you can see that price fell after the RSI overbought signal and the same thing happened again after the RSI over-sold signal — price move higher. Now the question is how to catch these movements? The breakout strategy comes very handily in this kind of scenarios. Why we wait for a breakout? By waiting for the breakout we can increase the probability of our trade. According to the above chart first, we wait for RSI over-bought signal then we wait for local structure level to be broken to the downside.

Now all we have to do is place our orders, right? As the above chart showed we placed sell orders after the breakout and placed stop-loss few pips above the moving average.

We use 2R for the take profit. Next, I have a question for you. If you like any of these trading strategies, How you are going to interpret these strategies to your trading career?

Just head over to any currency pair and going to trade these strategiesis that what you are going to do? If you like any of these strategies, I highly recommend you go over a few historical chart check whether these trading strategies are going to work or not. Also, make sure to check whether these strategies are suits for your personality or not.

Personality check is very important. Because you cannot profit from any trading strategy which is not suited for your personality. Just like that successful forex trading involve unique sets of skills, and anyone can develop that skill.

All you have to learn is how profitable traders THINK and what sets them apart from the rest. Well, there is no secret. Yuan Byeajee — A successful trader — has an article on The Thinking Process of Highly Profitable Traders. Read this article to learn more about how successful traders think. Also, consider reading the Trading in the Zone by Mark Douglas, best ib forex for daily trade. This is a good and must-read trading book for any trader.

Save my name, email, and website in this browser for the next time I comment. Home Trade Article Daily Time Frame Forex Trading Strategy 3 Ways to Trade Daily Chart. Daily Time Frame Forex Trading Strategy 3 Ways to Trade Daily Chart. Share 9. LEAVE A REPLY Cancel reply. Please enter your comment!

Please enter your name here. You have entered an incorrect email address! A Place for Proven Trading Strategy and Trading Education. Get Started. Trade Article Trade Ideas. About Us Contact Us.

Day Trading Brokers Canada 2021 (in Less than 5 Minutes) IBKR, TradeZero, Questrade, Think or Swim

, time: 4:49Currency Trading | Interactive Brokers LLC

10/16/ · That’s all. This is the end of the first daily time frame forex trading strategy. Have a look at the two examples that we executed in the last month before move into the next trading strategy. This is a trend continuation trade on EURUSD that we placed on 20th in June. And the next trade is on blogger.comted Reading Time: 8 mins Trade stocks on overseas exchanges and attach an FX order to the equity trade to hedge the currency you want at the time of trade. Large-Size Order Facility 1 Large-Sized Order quotes are specific to the order quantity entered are generated based upon an aggregation of quotes provided by interbank dealers to help get the best execution possible and minimize market impact 2/26/ · Pips Daily Forex Chart Strategy With 3 EMA’s. Trading off the daily chart with 3 exponential moving averages system and forex buy/sell oscillator. Our aim is to make pips on each trade. This simple system requires very little maintenance. You’ll only Estimated Reading Time: 40 secs

No comments:

Post a Comment