Aug 16, · Flag dan pola Pennant Forex Indikator adalah Metatrader sebuah 4 (MT4) indikator dan esensi dari indikator teknis ini adalah untuk mengubah data sejarah akumulasi. Flag dan pola Pennant Forex Indikator memberikan kesempatan untuk mendeteksi berbagai keanehan dan pola dalam dinamika harga yang tidak terlihat dengan mata telanjang Sukses Trading Forex dengan Pola Flag. Pola ini memiliki 2 komponen, yakni tiang (flagpole) dan bendera. Pembentukan tren yang cukup kuat mewakili tiang sedangkan koreksi yang terjadi setelahnya bisa diartikan sebagai bendera, dengan pola highs dan lows harga yang membentuk 2 garis paralel. Pola flag terdiri dari dua macam, yaitu bearish flag Estimated Reading Time: 2 mins Analisa Terlihat pada chart H1 dan H4 membentuk bearish Flag Pattern, kita mesti menunggu candle H4 nya closing di luar channel. Skenario SELL Entry tunggu closing candle H4 SL dan TP tertera di gambar Jika anda menyukai analisa ini, jangan lupa Like dan Share nya, dan juga jangan lupa untuk follow akun ini, untuk mendapatkan analisa terbaru

Bendera / Flag — Motif-Motif Chart — TradingView

Pattern trading is one of the branches of trading that has withstood the test of time. There are small cap stocks day traders who have been successful scalping the market while there are also a lot of forex day and swing traders who have made consistent profits through pattern trading. Among the many basic patterns used in trading, there are a couple of continuation patterns that have a great degree of success and at the same time could be explained why price does it what it does with these patterns — the flags and the pennants.

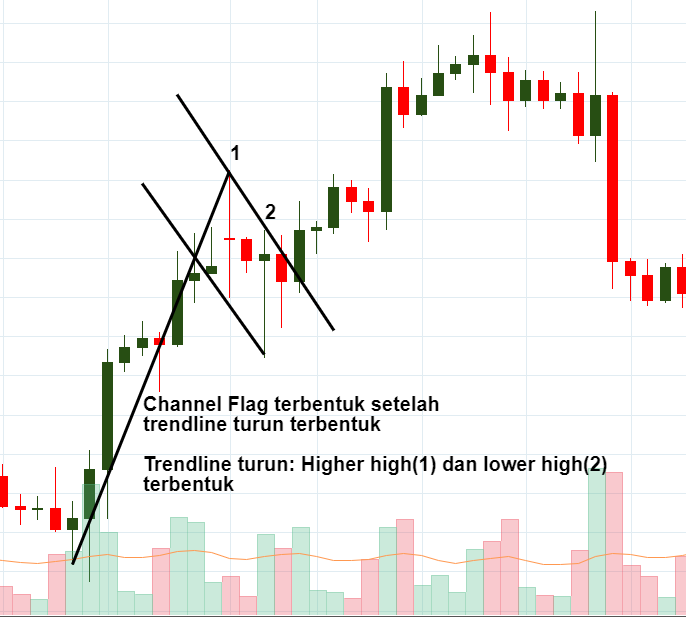

Below is a diagram of how they should look like. The flag pattern is a pattern with a support and resistance that goes against an initial thrust.

This support and resistance forms a channel which makes up the flag. Take note that flags usually go against a prior thrust. This thrust forms the pole of the flag. Being that the channel formed goes against a prior thrust, the flag pattern is an expansion phase followed by a retracement.

As most retracements do during a trending market environment, it is usually followed by another expansion phase. Next, the pennants. Pennants are almost the same as flags. Like the flag, it is also preceded by a thrust forming its pole. The difference is that instead of a channel, the supports and resistances tend to contract. In essence, beda flag dan channel forex, pennants are the contraction and retracement phase after a rapid expansion.

Now, the market usually moves in a sequence of expansions and contractions. As this theory would suggest, right after the pennant is formed, which is the contraction phase, another thrust could be expected. Although flags and pennants are highly reliable, with a naked chart, it is often difficult to spot for an untrained eye.

But there are ways to identify them a bit easier, beda flag dan channel forex. These EMAs are a pair of moving averages that work well as a support or resistance area. On a trending market environment, these are areas that we could expect price to retrace beda flag dan channel forex and then bounce back. Given this characteristic of these 2 EMAs, we could use them as a dynamic support and resistance where we could expect retracements and contractions to occur during a trending market environment.

This strategy is aimed at improving our skills in identifying flag and pennant patterns, which we often miss on a naked chart. By adding the EMAs, we now have an area where we could anticipate these flags and pennants to take shape. If we spot one, then all we have to do is wait for the breakout, then enter the trade. We will also be adding the EMA as a filter to identify the main long-term trend direction.

By trading according to the direction of the main trend, we improve our chances knowing that we have lesser headwinds in front of us. This is a working strategy. What you could do with this strategy is to cycle through all the currency pairs that you trade. I would suggest that you look at everything except the exotics. These patterns do work on the exotics, but because some currencies are manipulated by the central banks, the pattern could be voided.

Beda flag dan channel forex you look at all the pairs that you are trading, cycle through the timeframes until you find a viable pattern. Then, create a shortlist or watchlist of the currency pairs and timeframes where you found a pattern, then keep a close watch on them until the breakout occurs. One thing to consider though when taking a trade is the reward-risk ratio. There will be setups beda flag dan channel forex will have low reward-risk ratios if you are targeting the highs or lows of the pole, beda flag dan channel forex.

Some traders would rather aim for the same length as the pole. You could do this if you feel a bit aggressive, although as a warning, the lows or highs of the pole are already in itself a horizontal support or resistance. Other traders on the other hand opt not to take trades if the reward-risk ratios are low based on the target take profits. Some traders would opt to take trades above 1.

The latter is quite difficult to accomplish but could be done if you would go down a timeframe lower for a more surgical yet riskier entry. This strategy is one of those strategies that would work out of the box but requires a lot of practice and screen time, beda flag dan channel forex.

This is because you would have to learn to identify the patterns, beda flag dan channel forex, but not only that, you would also have to identify the right supports and resistances and the right breakout candles. The essence of this forex system is to transform the accumulated history data and trading signals.

Based on this information, traders can assume further price movement and adjust this system accordingly. Click Here for Step By Step XM Trading Account Opening Guide. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform. Get Download Access. Save my name, email, and website in this browser for the beda flag dan channel forex time I comment. Sign in. your username. your password. Forgot your password? Get help. Password recovery. your email. Home Forex Strategies Flags and Pennants Forex Trading Strategy.

Forex Strategies. Table of Contents 1 Flags and Pennants Forex Trading Strategy 1, beda flag dan channel forex. RELATED ARTICLES MORE FROM AUTHOR. Gann Reversal Forex Trading Strategy. eWaves Trend Forex Trading Strategy.

HAMA Trend Re-Entry Forex Trading Strategy. Price EMA Reversal Forex Trading Strategy. Free Scalp Forex Trading Strategy, beda flag dan channel forex. LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! Top Download MT4 Indicators List. Infoboard Indicator for MT4 December 17, Candle Closing Time Remaining Indicator for MT4 November 10, TMA Slope Alerts Indicator for MT4 December 17, MA BBands Indicator for MT4 December 17, Renko Charts Indicator for MT4 November 9, Forex Trading Strategies Explained.

Forex Channel Trading Strategy Explained With Examples November 5, Forex Candlestick Patterns Explained With Examples September 25, Forex Support And Resistance Strategy Explained With Examples October 15, How to Use Forex Factory Free Trading Tools beda flag dan channel forex The Ultimate March 23, Forex Stochastic Strategy Explained With Examples October 10, Recommended Top Forex Brokers.

FBS Broker Review — Must Read! Is FBS a Safe January 7, XM Trading Account Opening Guide March 26, FXOpen Broker Review — Must Read! Is FXOpen a Safe November 9, XM Broker Review — Must Read! Is XM a Safe POPULAR POSTS. Recent Posts. Gann Reversal Forex Trading Strategy June 30, Round Levels XN MT5 Indicator June 29, ITrend Indicator for MT4 June 29, POPULAR CATEGORY. About Us Contact Us Privacy Policy Disclaimer Forex Advertising. All rights reserved.

Belajar Trading Forex Price Action ~ Flag Limit

, time: 20:28How to trade Flags and Pennants Chart Patterns

Jan 03, · Flags and pennants chart patterns are primarily known for signaling a continuation of the previous trend. The flag or pennant chart pattern is formed right after a bullish or bearish price movement followed by a period of consolidation. This is where price tends to take a pause before continuing in the original direction of the trend/5(22) Karena, bentuknya mirip dengan bendera (flag) dan tiangnya (flagpole). Flag direpresentasikan oleh channel kecil sedangkan flagpole-nya adalah titik a ke b yang terlihat pada gambar di atas. Pada bearish flag, tembusnya lower line dari up channel adalah konfirmasinya. Harga cenderung akan bergerak turun jika bearish flag sudah terkonfirmasi Aug 16, · Flag dan pola Pennant Forex Indikator adalah Metatrader sebuah 4 (MT4) indikator dan esensi dari indikator teknis ini adalah untuk mengubah data sejarah akumulasi. Flag dan pola Pennant Forex Indikator memberikan kesempatan untuk mendeteksi berbagai keanehan dan pola dalam dinamika harga yang tidak terlihat dengan mata telanjang

No comments:

Post a Comment