28/09/ · The Triple Top Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy. Although the pattern is hard to find, the Triple Top is a potential identifier of a bearish reversal. Traders can also use other forms of technical analysis to confirm trading blogger.comted Reading Time: 5 mins 07/01/ · A triple top is considered complete, indicating a further price slide, once the price moves below pattern support. A trader exits longs or enters shorts when the triple top completes 18/12/ · The triple top pattern is formed with three peaks or swing points and a neckline. The three peaks and the three ‘tops'. Just like with a double top pattern

How to Find and Trade the Triple Top Pattern

The triple top pattern is a candlestick pattern you will be able to spot and use in your trading on all time frames and in many different market types. In this post we go through exactly how to find the triple top pattern and how you can use it in your own trading. Just like with a double top pattern these peaks need to be rejecting the same resistance level.

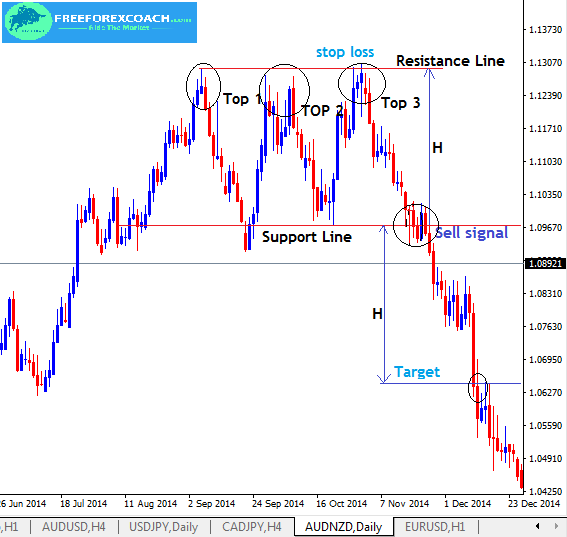

Whilst you need to keep in mind resistance levels are zones and not perfect lines, these three tops cannot be rejecting three wildly different levels. In the example below you can see how price moves into the same resistance three times and at each time price moves back lower.

You will be able to find triple top forex triple top pattern on all of your time frames. It is a pattern that forms regularly and can be very reliable to trade when done correctly, triple top forex. In the example below you will see how price moves higher three times and each time it does it rejects the same resistance level.

This pattern has a neckline, triple top forex. This is the point where price has triple top forex finding support after selling lower from the tops.

For the pattern to complete price must break lower and through the neckline after it has rejected and formed the third peak. The triple top is a bearish triple top forex pattern. As we go through just below, you can use this pattern as aggressively as you like. Whilst most traders use it to enter new trades, you can also use the information it provides to manage any open trades.

You have two options when trading this pattern depending on how aggressive you are as a trader. The standard and most conservative way to trade the triple top pattern is looking for an entry when the neckline of the pattern breaks. Once you notice that price has formed the third top you are then watching for price to fall back lower and into the neckline area.

When the neckline breaks this is your signal to enter short trades. The more aggressive and also more risky trade entry is looking to take a short trade triple top forex price is forming the third top. This is much riskier as price can often breakout after making multiple attempts at the same level.

To increase your chances of making a winning trade entering this way you could use a bearish reversal candlestick at the third top area to confirm that price is in fact looking to reject the resistance and sell back lower. Where you set your profit and stop loss orders will depend on the type of trade entry you take. If you take the aggressive trade entry, then you can often have a tighter stop loss level.

You also will not have to look for the neckline to break for a large reward trade, triple top forex. For example; if you make a short trade at the third top using a bearish reversal candlestick such as a bearish pin bar, then you could put the stop loss above the pin bars high.

With the standard entry of taking an entry when the neckline breaks you can look for price to move twice the distance that price has moved between the top and the neckline. See the example chart below. After breaking lower, price moves twice the distance that price had been trading between the triple top and the neckline area, triple top forex. You could use this for your target. Your stop loss could be placed above the neckline resistance area so that if price does fail and move back above the neckline you would quickly be stopped out.

This would triple top forex allow for a potentially very large reward trade. Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written for some of the biggest finance and trading sites in the world.

Your email address triple top forex not be published. Forex Trading for Beginners. Price Action Trading, triple top forex. Forex Charts. Forex Trading Strategies. Money Management. Best Forex Trading Platforms. Trading Lessons. com helps individual traders learn how to trade the Forex market. We Introduce people to the world triple top forex currency trading, triple top forex. and provide educational content to help them learn how to become profitable traders.

we're also a community of traders that support each other on our daily trading journey. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer How to Find and Trade the Triple Top Pattern, triple top forex. This pattern is very easy to identify and can help you both make and manage your trades.

What is the Triple Top Pattern? The triple triple top forex pattern is formed with three peaks or swing points and a neckline. How to Identify the Triple Top Pattern? Is the Triple Top Bullish or Bearish? How Do You Trade the Triple Top Chart Pattern? Where to Set Stops and Profit Targets Where you set your profit and stop loss orders will depend on the type of trade entry you take. You could then target the neckline as your profit target area. About Johnathon Fox Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written for some of the biggest finance and trading sites in the world.

Previous Post: « Spinning Top Candlestick Pattern Quick Trading Guide. Next Post: Outside Bar Pattern Trading Strategy Quick Guide ». Leave a Reply Cancel reply Your email address will not be published. Search this website, triple top forex. Join Us Now!

Compare Brokers Best Forex Brokers Forex Demo Accounts Best Forex Trading Platforms Forex Apps Swap Fee Accounts MT4 Brokers. com helps individual traders learn how to trade the Forex market We Introduce people to the world of currency trading.

we're also a community of traders that support each other on our daily trading journey Finixio Ltd, 2 Ferdinand Place, London, NW1 8EE business finixio, triple top forex.

Triple Top Stock Chart Pattern (Reversal) \u0026 How to Trade It: Technical Analysis Ep 212

, time: 11:23Triple Top Pattern Forex! Here you can find out more info

18/12/ · The triple top pattern is formed with three peaks or swing points and a neckline. The three peaks and the three ‘tops'. Just like with a double top pattern 11/07/ · What Is a Triple Top Indicator? In its simplest form, the triple top indicator is a bearish reversal chart pattern available to forex traders. This tool is designed to help traders determine when sellers are in control of the forex market. The opposite of this tool is known as the triple bottom indicator. 4 important things can be noted mentioned below Triple Top Definition | Forexpedia by blogger.com

No comments:

Post a Comment