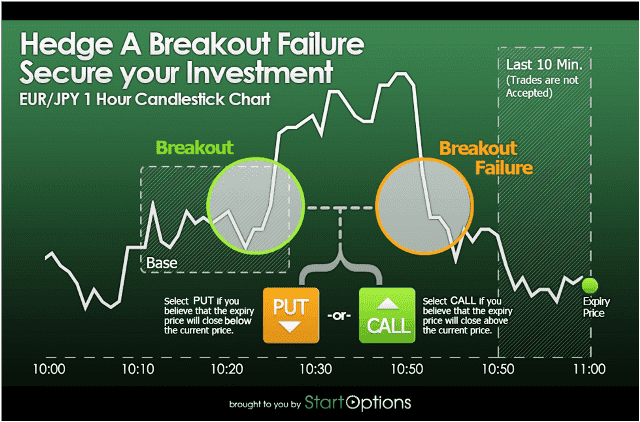

31/1/ · If you choose to hedge your bet by placing a PUT Binary Option trade when the breakout fails, the trades now cancel each other out resulting in a $15 loss instead of a $ loss (win $85 – lose $ = $15). So let’s assume that 50% of breakouts succeed, in a pessimistic blogger.comted Reading Time: 2 mins If you have a binary options account as well as a Forex account, another thing you can do is use the binary option as a hedge against your Forex bet. In other words, instead of making your binary option your primary trade and your Forex trade your “insurance” against a loss, you can make the binary option your “insurance,” and your Forex trade your main trade Nonetheless, a lot of Forex traders avoid binary options because they are expensive. A winning trade typically pays out 65% to 85%, but a losing trade will usually only carry a 10% refund. There’s a gap there in the broker’s favor, and it can add up to more than your Forex spread

Hedging in Binary Options Trading - How to Implement Hedges for Binary

First off, if you are not familiar with a No-Touch option, it is a simple variation on a One Touch option. One Touch options are some of the most common binary options. When you purchase a One Touch contract, it works like this: You look at a given asset, and you wager that the price will touch a certain trigger value before the binary option expires.

If you are right, you win a payout. If you are wrong, you lose the trade. A No-Touch trade is the same thing, except you wager price will not reach the trigger value, forex hedging binary options. No-Touch options are an interesting opportunity, because you are able to profit from the market not moving. You cannot do that in Forex, because in FX, you can only profit off of price rising or falling.

Nonetheless, a lot of Forex traders avoid binary options because they are expensive. You may feel more comfortable trading a binary option if you can take some of the risk out of the equation, and that is where hedging comes into play. Anytime you hedge while trading, you are covering all your bases by setting yourself up to try and profit regardless of what the market actually does. Open up your Forex account, and navigate to the right currency pair.

Take a look at your no-touch option. Are you wagering that price will not go up, or that price will not go down? If you are wagering price will not go up, forex hedging binary options, then in your Forex account you will forex hedging binary options placing a buy order. If you are wagering forex hedging binary options will not go down, then in your FX account you will be placing a sell order.

Set your take-profit to the value of the trigger level in the no-touch trade. If you set your position size in Forex hedging binary options to the same amount you are risking in your no-touch trade, and the trigger value is hit, you will lose your binary options trade, and win the same amount back in FX. Of course, if the binary option wins, but the currency moves down, you will lose the currency trade.

And the danger of not setting a stop is that you could have potentially infinite losses on the FX trade. So if the Forex trade falls far enough, it could eliminate your binary forex hedging binary options winnings, forex hedging binary options, and even land you in the red.

The logical thing to do to prevent infinite losses in your Forex account is naturally to set a stop loss. There are numerous different techniques you can use to set a stop loss; the forex hedging binary options ones usually are those that have some basis in what price is doing support or resistance, a Fibonacci level, etc.

The tighter your stop, the less money you can lose. Setting a smart stop loss and hedging that way typically leads to a more positive outcome, forex hedging binary options.

You have several chances to attain profit on one or both trades. There is still the possibility of a breakeven result, but the odds of a loss decrease and your loss will be finite. Does your binary options broker provide you with an forex hedging binary options closure feature to get out of a trade early? The conditional hedging scenario is more or less the same setup as above, but you take advantage of the early closure tool if your stop loss is triggered in your Forex trade.

While the profit will be small, it may cover some of your Forex losses. How do you decide which type of hedging tactic to employ?

As you have probably realized, there are a lot of complex calculations you can do for any given trade which will exactly tell you what your risk is given a variety of different scenarios. If you are totally confident in your trade, you may not have a need to hedge, forex hedging binary options.

Otherwise, you can save yourself a lot of time and mathematical errors by using a hedging calculator for no-touch binary options. With this calculator, you can input your binary account currency, the option price and payout for a given currency pair, the strike rate, the current bid rate for the currency, forex hedging binary options, the stop-loss price, and the type of hedging method you are interested in any of the method above. The calculator will generate a set of possible outcomes based on the information you have provided and the method you have selected.

The result? An exact calculation of your possible losses or gains. Try running through the information with each hedging approach, compare the results, and see which method is likely to reduce your risk exposure the most and give you the best chance at success. Hedging is a great way to protect your account from losses. With the aid of this calculator, you can save time and money on your journey toward profit. Hedging No-Touch Binary Options with a Spot Forex Position Contents What Is No-Touch?

How to Hedge Your No-Touch Option No Hedge Simple Hedging Without a Stop Loss Simple Hedging with a Stop Loss Conditional Forex hedging binary options with a Stop Loss Use a Hedging Calculator to Choose Your Approach Share and Enjoy! Share and Enjoy! Read more articles on Strategy. Binary Trading.

How to reduce Risk \u0026 Losses in Binary Options Trading - Hedging Strategies

, time: 14:34Easy How To: Use Hedging With Binary Options | Forex Crunch

Nonetheless, a lot of Forex traders avoid binary options because they are expensive. A winning trade typically pays out 65% to 85%, but a losing trade will usually only carry a 10% refund. There’s a gap there in the broker’s favor, and it can add up to more than your Forex spread Trading binary options can help you hedge your losses, and improve your overall performance on the spot Forex market. What is Hedging? When you hedge, it means that you trade against your initial inclination. If you enter a short Forex trading position on EUR/USD, your hedge trade would be something that reflected a gain for the euro over the US dollar Binary Options Hedging Strategy with a High Success Rate

No comments:

Post a Comment