Jan 17, · 10# Binary Options strategy RSI and SFX MCL filtered by Trend Reversal; 11# Binary Options Strategy: William's % Range with (Buy Zone and Sell Zone) 12# Binary Options Strategy: Stoclye with I-High Low Middle; 13# Binary Options Strategy: CCI rpn indicator; 14# Binary Options Strategy High/Low: pattern with Retracement Feb 03, · 15 min RSI-4 – This short term binary options trading strategy is one of the simplest of strategies for trading very short term binary options contracts. Who is this strategy ideal for? This short term expiry binary options strategy is ideal for intraday binary options traders. This means that traders will have to constantly be on the alert for the right signals to trade. The 15 minute chart is used as a /5(45) Jun 28, · The Relative strength indicator (RSI) is an indicator used by technical analyst to determine if an asset is over bought or oversold, but it also can be used as a divergence indicator when trading binary options. The RSI can be used alone, or in conjunction with other indicators to create a robust signal to trade the binary options market

15 min RSI-4 Binary Options system

The Relative strength indicator RSI is an indicator used by technical analyst to determine if an asset is over bought or oversold, but it also can be used as a divergence indicator when trading binary options.

The RSI can be used alone, or in conjunction with other indicators to create a robust signal to trade the binary binary option rsi strategy market. The most common way to use the relative strength indicator is as a mean reverting indicator that would alert a trader that momentum in the asset is slowing and a potential bottom could be near. The RSI measures recent closes relative to further closes to determine binary option rsi strategy momentum is accelerating or slowing.

The RSI creates an index, which determines overbought levels or oversold levels. The index is measure from to 0 where levels above 70 are considered overbought, binary option rsi strategy, where levels below 30 are considered oversold.

The chart below examines 2 specific ways that a trader can initiate a binary options trade using the relative strength indicator. When using the index as specifically an overbought or oversold index, a trader can look for periods where the hourly chart of an asset meets the overbought or oversold criteria. The WTI chart below shows two specific periods where the hourly chart had an RSI index readying below the 30 level, binary option rsi strategy.

This can be used as a coincidental indicator meaning that the market should snap back to a mean relatively quickly. A second way to use the RSI is to look for periods where the RSI and the price chart diverge. A divergence occurs when the price bar rises to a new recent high, and the RSI does not create a new high. An example binary option rsi strategy divergence is displayed in the chart below.

Both strategies can create robust results when trading binary options, binary option rsi strategy. The combination of a reading above 70 or below 30 combined with a divergence in prices with the RSI is even a more powerful indicator. To trade the binary options market with the RSI, above and below, hit or miss and range options all can give a trader robust returns.

For mean reversion using the RSI indicator, a trader can buy an above option when the market reaches 30 and buy a below option when the market reaches Another strategy would be to buy a miss option and place your miss range below the market when the RSI gets to the 30 or even 20 level. The reverse can be transacted when the market gets to the 70 or 80 level, binary option rsi strategy. When a divergence comes, a trader can also use a below option to take advantage or prices moving down, and an above binary option rsi strategy for a divergence on the downside.

The RSI indicator works well with many assets and a trader should test multiple assets with this indicator to find the assets that work best with the relative strength indicator. Skip to content The Relative strength indicator RSI is an indicator used by technical analyst to determine if an asset is over bought or oversold, but it also can be used as a divergence indicator when trading binary options. The Secret to Analyzing Binary Options Strategies Protective Put Linear Regression Channels.

About The Author Juliana.

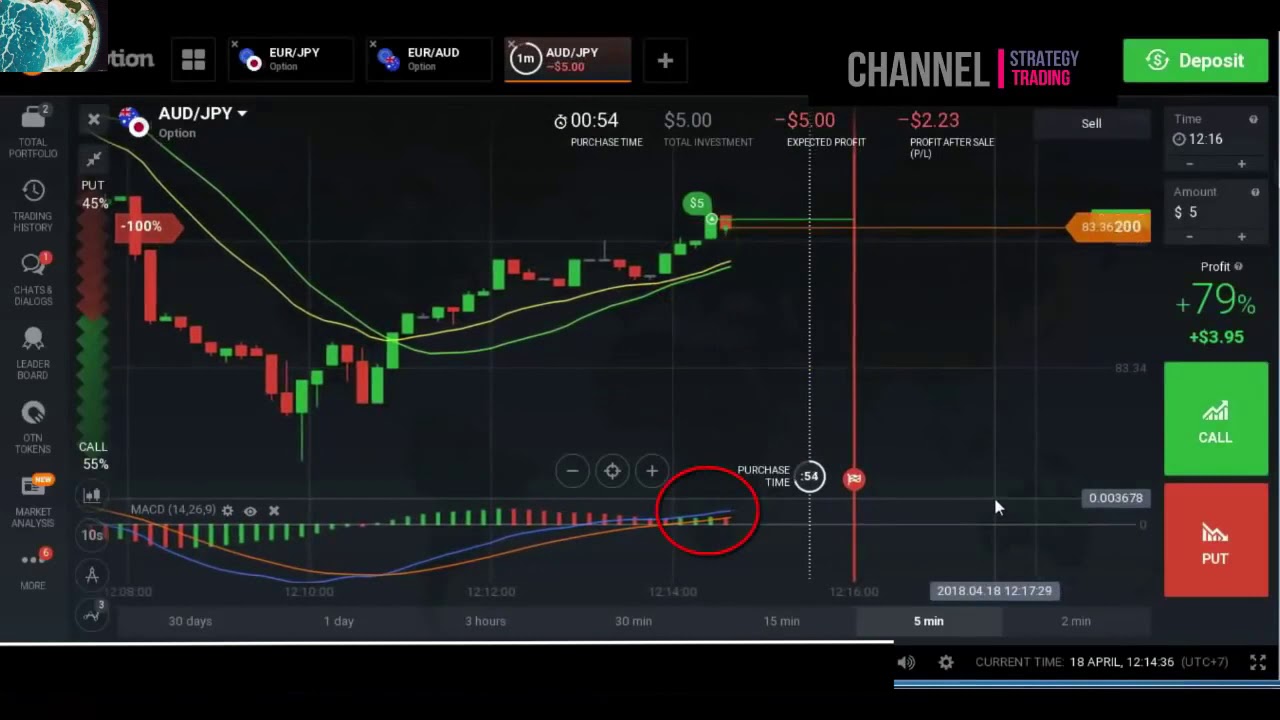

Pocket Option Easiest Strategy - Moving Average and RSI combination

, time: 6:49minute Binary Options Strategy using RSI, Stochastic Oscillator and EMAs

Just add the RSI to your chart, click on the dropdown menu next to “RSI” and select “Add Indicator.” From the list that comes up, pick “moving average.” RSI Settings. The standard RSI setting is 14, although that is typically used on daily charts, so if you are trading a shorter time frame you need to do some experimenting The Laguerre RSI binary trading strategy is based on the blogger.com4 indicator. This indicator functions like an oscillator and is able to detect oversold and overbought conditions. It can also be used to trade divergences. The strategy described today is the divergence BO strategy with the Laguerre RSI Estimated Reading Time: 2 mins Binary Options RSI Strategy: Chart combination. As we said before, it is not good to only use the RSI indicator for open trades. The RSI is a lagging indicator which has not a good hit rate when it is used solo. So I recommend to analyze the chart and search for support and resistance levels

No comments:

Post a Comment