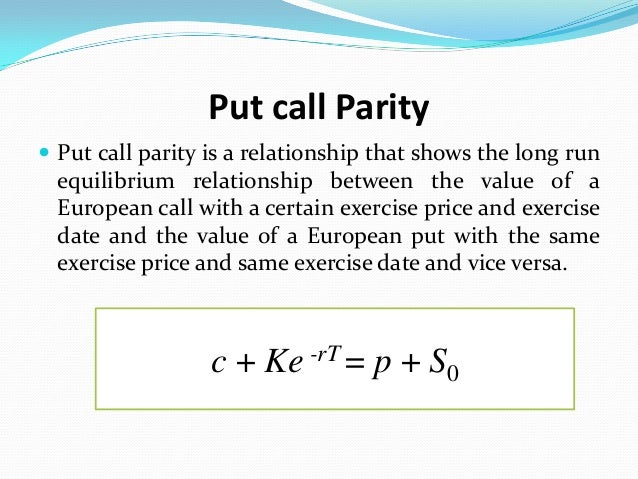

I've been Binary Option Put Call Parity wanting to learn more about how to trade retracements and see divergence and Cynthia's Advanced Neon Breakout has the extra divergence indicator that makes seeing momentum and trend change coming. Her training videos in the PDF are excellent and I'm learning all about trading retracements and re-entries/10() 5. 8. · Put call parity for binary options Put-Call Parity does not hold true for the American option as an American option can be exercised at any time prior to its expiry. Equation for put-call parity is C 0 +X*e-r*t = P 0 +S 0. In put-call parity, the Fiduciary Call is equal to Protective Put 5. · so put-call parity for the call and put digital options would be { − 1 = S − K e − r (T − t), i f S (T) ≤ K 1 = S − K e − r (T − t), i f S (T) > K?

Put–call parity - Wikipedia

Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. It only takes a minute to sign up. Connect and share knowledge within a single location that is structured and easy to search.

I'm looking for put-call parity for the call and put digital options, but I don't really know what is digital options and it's difference between binary options. Generally, I would say binary option put call parity is a bit difficult to look for put-call parity of something you do not know what it is in the first place.

To give more intuition to what fesman wrote, look at your C and P equation. That is just because it is the most natural way to look at it. Combined, call plus put, will give you 1 no matter the outcome. That payoff, will be in the future though, so you discount to today. Furthermore, it can be any monetary value. This is the cash or nothing variant. The other variant is not important here but intuitively, if binary option put call parity get the asset, further increases or decreases in Spot above or below the strike have an impact on the actual value.

Assume the asset has a strike of and you receive either USD or 1 asset. However, 1 asset will only be worth if spot is equal to strike. Simplified, it is like flipping a coin binary means one of two outcomes. Heads you win 1 or any agreed cash paymenttails you lose get nothing. In a fair coin example, the price will be 0. Assume you agree to play in 1 year today.

You can still expect to get 0. At least theoretically. In reality they are usually priced as call spreads. Sign up to join this community, binary option put call parity. The best answers are voted up and rise to the top. Stack Overflow for Teams — Collaborate and share knowledge with a private group. Create a free Team What is Teams? Learn more. Asked 1 month ago. Active 1 month ago. Viewed 94 times. finance-mathematics binary-options. Improve this question. asked May 14 at Saguro Saguro 11 2 2 bronze badges.

binary options and digital options are the same thing. in theory you have "cash-or-nothing" and "asset-or-nothing" variations. I have only seen the former in practice. What kind of put-call parity can I use for binary options then? Add a comment. Active Oldest Votes. Call: binary option put call parity get 1 if spot ends up above strike Put: you get 1 if spot is below strike. Improve this answer, binary option put call parity. answered May 14 at AKdemy AKdemy 1, 1 1 silver badge 19 19 bronze badges.

Sign up or log in Binary option put call parity up using Google. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. Email Required, but never shown.

The Overflow Blog. State of the Stack Q2 Linked 2. Related Hot Network Questions. Question feed. Quantitative Finance Stack Exchange works best with JavaScript enabled. Accept all cookies Customize settings.

Put-call parity - Finance \u0026 Capital Markets - Khan Academy

, time: 3:29Options Arbitrage Opportunities via Put-Call Parity

1. 9. · Put Call Parity of Binary Options Since the price of Binary options reflect the probability of the options ending up in the money by expiration, put call parity in binary options are reflected in the fact that the put call parity for binary options ask price of one option and the bid price of the other at the same strike price will always be equal to $/5 5. · Put-call parity is a principle that defines the relationship between the price of European put and call options of the same class, that is, with the same underlying asset, strike price, and 5. · so put-call parity for the call and put digital options would be { − 1 = S − K e − r (T − t), i f S (T) ≤ K 1 = S − K e − r (T − t), i f S (T) > K?

No comments:

Post a Comment