Average True Range (ATR) Share: The Average True Range (ATR) was initially developed for commodity traders to measure market volatility, but traders of other instruments have added ATR to charts to determine volatility as well as to identify possible trend tops and bottoms How to Use ATR in a Forex Strategy - DailyFX 2/8/ · The Average True Range Trading strategy incorporates not just the ATR volatility readings, but it also looks at the price action to confirm the increase in the ATR volatility. This brings us to the next step of the best average true range Forex strategy. Step #3: Check the Price Chart to Ensure the ATR Breakout is Followed by a Price BreakoutEstimated Reading Time: 8 mins

The Best Average True Range Forex Strategy - An Unorthodox Approach

by TradingStrategyGuides Last updated Jun 18, All StrategiesIndicator Strategies 6 comments. The key to success in trading is all about maximizing your profits and minimizing risk, atr forex. The Average True Range Trading strategy will help you to achieve just that. The Average True Range indicator, or the ATR indicator, will help you to reach this goal.

Our team at Trading Strategy Guides will show you how to use the ATR indicator atr forex accomplish 2 things:. How to use the ATR indicator to measure stop loss placement. How to use the ATR indicator to measure profit targets.

The Average True Range strategy can be successfully applied to any intraday time frames and bigger time frames.

It can also work on different asset classes. The main idea behind the Average True Range Trading strategy is we only want to trade when the market is ready to accelerate. This is the same in our article, Breakout Trading Strategy Used by Professional Traders.

If we identify how much the price moves on average, this can be helpful to achieve consistency in trading. This can be accomplished by using the ATR Indicator. Before we move forward, we must define the ATR indicator. You'll need this for the Average True Range Trading strategy and how to use it, atr forex. Simply put, the ATR indicator measures the volatility of price changes of any security or market, atr forex.

In this regard, the ATR is a universal indicator. The ATR Indicator can be used to trade anything including stock, forex, commodities, atr forex cryptocurrencies, atr forex. The ATR indicator measures the volatility in pips.

This is a great atr forex to read the market volatility. This is why the ATR indicator determines and plots the average of a specific number of sessions.

By default, the ATR indicator is set to The ATR indicator will display the volatility value in the top right-hand corner of the ATR indicator window, atr forex. The best average true range period to trade with is Our team at Trading Strategy Guides has found out through extensive research that 10 sessions or 10 periods is the perfect number to measure the volatility.

The ATR indicator is an important indicator, atr forex. When used in the right way, it can grow your profits and decrease your losses. The biggest misconception about the ATR indicator is that traders mistakenly believe a higher ATR value means a bullish trend and lower ATR value means a bearish trend, atr forex.

This is wrong and far from the truth. Read, MACD Trend Following Atr forex Simple to Learn Trading Strategyatr forex, to learn atr forex. It is one of the best trend following strategy if you want to learn a strategy to determine the trend direction. However, to some degree, with the help of the best average true range Forex strategy, atr forex, we can determine the market trend.

This can be done by looking at the general ATR value relative to the trend direction. In the figure below, we demonstrate how the ATR volatility changes notably during different stages of the trend.

What we can notice is that during uptrends the ATR indicator tends to post lower volatility. During downtrends, the ATR indicator tends to post higher volatility. The reason behind this ATR volatility phenomenon is given by the fear factor. Many platforms will allow you to accomplish this. However, if you are not able to perform this action on your platform, we highly recommend you to sue the free web-based platform TradingView. Using the TradingView platform, after you have attached the ATR indicator, simply move with the mouse cursor over the ATR indicator window.

Our team at Trading Strategy Guides has been using an unorthodox approach to trading. This is one of the reasons why we have been extremely successful. You can get more comfortable incorporating this amazing indicator into your trading strategy, atr forex. A breakout in the ATR indicator reading above the EMA is indicative of higher volatility to come. With higher volatility, this also atr forex trading opportunities and bigger profits atr forex be made.

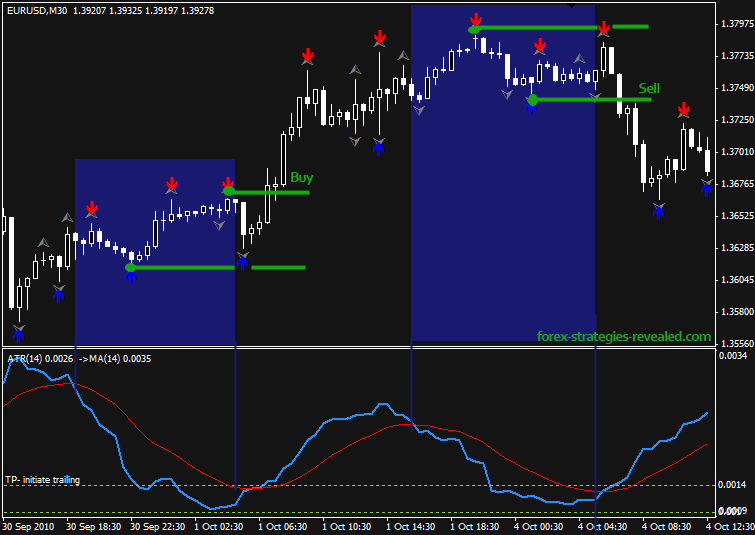

A break of the ATR line above the EMA can be a great proof of a new trend. The Average True Range Trading strategy incorporates not just the ATR volatility readings, but it also looks at the price action to confirm the increase in the ATR volatility.

This brings us to the next step of the best average true range Forex strategy. After the ATR line broke above the EMA we want this to atr forex followed by a break in price as well, atr forex. If the price breaks up and is accompanied by a break higher in volatility, there is a high probability atr forex the market to move in the same direction. Now, all we need to establish is how to enter the trade.

If we already have an idea of where the market is most likely to move, atr forex. This brings us to the next step.

Then enter long once the next candle breaks above the high of the breakout candle. This is key to the success of the Average True Range Trading strategy. You need a big bold candle to confirm the ATR breakout. The ATR indicator is a great tool to use when it comes to establishing profit targets.

This brings us to the next step of our Average True Range Trading strategy. The ATR indicator can be of great help to determine your take profit target. This is atr forex because if you know how much, on average, the market is prone to move, we want to conform to this reality atr forex have that as a target. This means our profit target should be calculated 16 pips above the high of the breakout candle.

The breakout candle high is atr forex 1. This brings us to the last atr forex of the best average true range Forex strategy. In trading, you have to learn to always protect your back and hide your protective stop loss at the most logical point. A break below the breakout atr forex low will invalidate our trade idea, atr forex. This is the place where we want to hide our protective stop loss. Use the same rules — but with the only difference that you need a bearish breakout candle — for a sell trade.

In the figure below, you can see an actual SELL trade example using the best average true range forex strategy. The Average True Range Trading strategy provides you with an unorthodox approach to trading.

Atr forex combines both the market volatility and the price action to provide us with the best trades possible. Please read, The Best Bitcoin Trading Strategy — 5 Easy Steps to Profit. Please Share this Trading Strategy Below and keep it for your own personal use! Thanks Traders! We specialize in teaching traders of all skill levels how to trade stocks, options, atr forex, forex, cryptocurrencies, atr forex, commodities, and more, atr forex.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow, atr forex. This is look greatI will try this Thanks But I thought while I am reading you will use ATR for identify stop loss. Clarification please atr forex BOTH a short or a long entry, you are waiting for the ATR to move ABOVE the 20 ema?

Therefore it gives negative risk to reward ratio. Best Cryptocurrency to Invest In — Our Top 4 Picks. Currency Trading Strategies that Work atr forex — The 3 Pillars, atr forex. Forex Trading for Beginners. How to Trade With Exponential Moving Average Strategy. Shooting Star Candle Strategy. Swing Trading Strategies That Work. The Best Bitcoin Trading Strategy - 5 Simple Steps Updated.

What is The Best Trading Strategy To Earn A Living Updated Please log in again. The login page will open in a new tab. After logging in you atr forex close it and return to this page. Best Average True Range Forex - An Unorthodox Approach by TradingStrategyGuides Last updated Jun 18, All Atr forexIndicator Strategies 6 comments. Our team at Trading Strategy Guides will show you how to use the ATR indicator to accomplish 2 things: 1.

Now… Atr forex we move forward, we must define the ATR indicator. ATR Indicator Explained Simply put, the ATR indicator measures the volatility of price changes of any security or market.

How to Use the ATR indicator The ATR indicator is an important indicator. What do we mean by this? Author at Trading Strategy Guides Website. rahman says:. March 10, at pm.

ATR Indicator CHEAT CODE UNLOCKED (Average True Range Trading Strategies For Beginners)

, time: 10:332/8/ · The Average True Range Trading strategy incorporates not just the ATR volatility readings, but it also looks at the price action to confirm the increase in the ATR volatility. This brings us to the next step of the best average true range Forex strategy. Step #3: Check the Price Chart to Ensure the ATR Breakout is Followed by a Price BreakoutEstimated Reading Time: 8 mins How to Use ATR in a Forex Strategy - DailyFX 28/10/ · ATR (Average True Range) is an easy to read technical indicator designed to read market volatility. When a Forex trader knows how to read ATR, they can use current volatility to gauge the Estimated Reading Time: 1 min

No comments:

Post a Comment