10/19/ · Asian Forex Session (Tokyo) When liquidity is restored to the forex (or FX) market at the start of the week, the Asian markets are naturally the first to see action So, the Asian session does not necessarily begin and end with the opening and closing of Tokyo as a center. Let us provide some key features regarding trade during the Asian session. the session begins at GMT and lasts until GMT on the next day, or from EDT to EDT during the summer period and from EST to EST during the winter period 3/11/ · What are the Tokyo forex market hours? The Asian forex session starts off the trading week on a Monday morning at and closes at in Japanese Standard Time (JST).Estimated Reading Time: 6 mins

Asian Trading Session

Please note: This strategy was publicly published in the trading community and is free to use. Therefore, we are mainly explaining the components and rules of the strategy.

If applicable, asian session forex, we are highlighting advantages, disadvantages and possible improvements of the strategy.

The Asian Session Forex Trading Strategy For MT4 is based on a fake breakout in combination with a subsequent real breakout of the Asian trading range. This strategy is specially designed to be used on the EURUSD pair. You will have 1 trade nearly every day because you are reacting to the price action during a special period of the trading day, asian session forex.

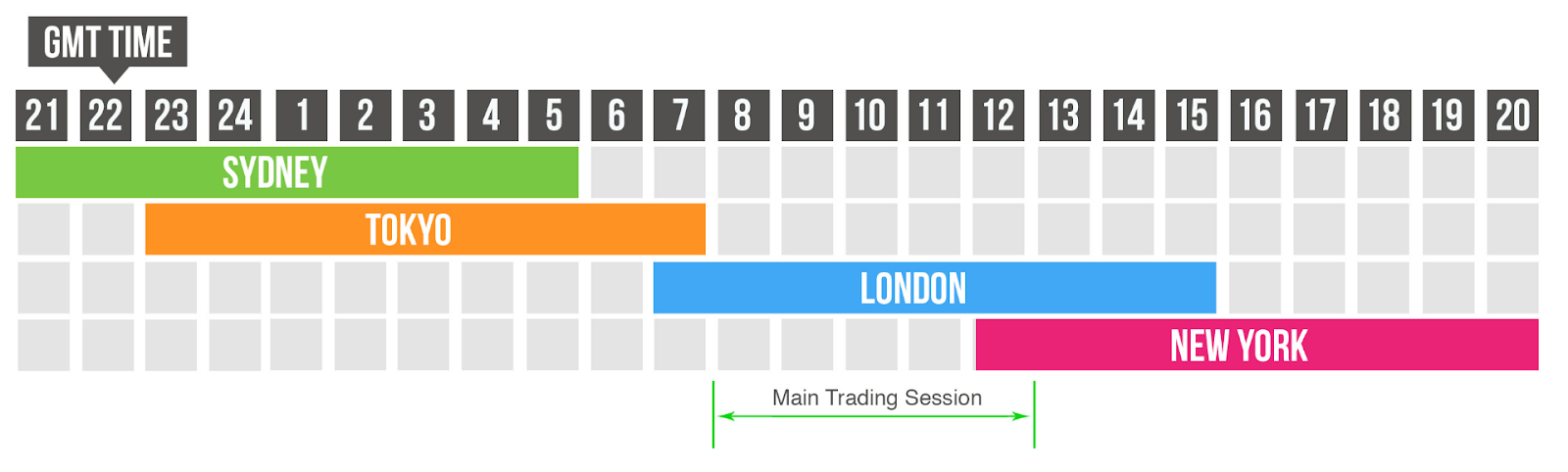

As you probably know the forex market is mainly divided into 3 sessions. The names of these sessions are European, asian session forex, US, and Asian Session. These sessions define the periods during which the corresponding continent is most active in the markets. FREE Asian Session Forex Trading Strategy Download the FREE Asian Session Forex Trading Strategy for MT4.

The biggest volatility is seen during the European and US session. The Asian Session Forex Trading Strategy For MT4 exploits the behavior of the megabanks. The megabanks usually drive the price out of the price range of the Asian session and then sharply reverses the price. The first move out of the Asian range is a so-called fake move. The sharp reversal after the fake move is the start of the real move of the upcoming European session.

After the real move has started you can open a trade in direction of the real trend, asian session forex. But to anticipate the trade signals, we need to depend on some asian session forex factors.

To take the trades with confidence, you need to the real functions of the essential elements used in this system. So, the trades which will be taken will be based on fundamental and technical analysis. And the process involves only manual labor, asian session forex.

Forex market is open 24 hours and five days a week, asian session forex. But in each day, investors across the globe participate in the trading process based on their active business hours. For instance, you can expect to experience a large volume of transactions in the European zone during the European session.

So, pairs like EURUSD, GBPUSD, asian session forex, asian session forex EURGBP will be volatile. But if you analyze the EURUSD or GBPUSD pair during the Asian trading session, asian session forex, you should see a consolidated pattern.

This is due to the fact, large banks, investors, and retail traders from the European zone are not active at that particular time. And we will be taking advantage of such consolidation in this system. The consolidation zone can be defined by the absence of volatility.

Due to the low volume transaction price of a particular asian session forex will be confined in a fixed range and it will be very hard to take the trades on such market condition. Right before the asian session forex of the Asian session or before the opening of the European session, we will notice an increase in the market volatility.

This sudden increase in the market momentum often results in the fake-out pattern formation which is the key to execute the trade by using the Asian Session Forex Trading Strategy For MT4. Fake is very similar to the false spike but it has more distinct characteristics.

Instead of behaving irrationally, the candlestick will spike in one direction but eventually settle down inside the consolidation box. Such a false move in the price is known as fake-out. The fake-out pattern is usually spotted right at the opening of the European trading session.

Asian session forex, the market starts to gain momentum in one direction and it allows the retail traders to execute new trades. Note that, asian session forex, most of the consolidation pattern breaks after the formation of fakeout pattern. As the price trades inside a consolidated box, you may spot rejection and bullish bounce in the market.

If the price of a certain asset test a resistance level asian session forex start to drop, you may call it as a bearish rejection. On the contrary, testing the support level and gaining bullish steam is known as bullish bounce. In general, the rejection and bullish bounce is identified with the help of a pin bar or fake out the pattern.

So, if you spot such a pattern, you may expect that a potential trade signal will form in the market. The success of this strategy is mostly related to trade timing, asian session forex. You have to start looking for the trade signals 1 hour before the closing of the trading session. And to find a valid trade signal, you need to cross-check few important metrics. Since the trade is taken based on the formation asian session forex the fakeout pattern, it is better to place the SL below the tail of the fake-out bar.

In case you are relying on the price action confirmation signal, use the low of the candlestick to determine the SL price. To determine the take profit, you should identify the nearest supply or resistance zone. But make sure you close the trade before the European session ends. Selling the currency pairs based on the Asian Session Forex Trading Strategy For MT4 is very similar to the long trade signals.

But in this method, we will use much easier conditions. You need to determine the stop loss by using the fakeout bar.

For conservative traders, the SL price might be set above the resistance level of the box. The take profit is generally set to the nearest support level. While riding the short trade, try to trade in the asian session forex of least resistance as it will help to secure the profit quickly. Breakout trading strategy is always very tricky. However, the Asian Session Forex Trading Strategy For MT4 mostly depends on the technical formation.

So, we suggest keeping yourself tuned to the economic news events while using this system, asian session forex. Getting yourself comfortable with the Asian Session Forex Trading Strategy For MT4 might require some time.

In the early stage, you should not use this system to trade with real money. Asian session forex is better to learn the sequence of this strategy by using a paper trading account. Keep your risk exposure low and be ready to deal with unexpected outcomes.

I'm Mike Semlitsch the owner of PerfectTrendSystem. My trading career started in Since I have helped thousands of traders to take their trading to the next level. Many of them are now constantly profitable traders. The following performance was achieved by me while trading live in front of hundreds of my clients :.

Connect With Me:. Results From 5 Months! This service starts soon! Be the first who get's notified when it begins! Request Strategy. Yes, I want to receive emails with explanations regarding the tool and the newsletter. First Name. Partially Automated Trading Besides Your Day Job. Alerts In Real-Time When Divergences Occur. About Me I'm Mike Semlitsch the owner of Asian session forex. The following performance was achieved by me while trading live in front of hundreds of my clients : Connect With Me:.

Request Information. Last Name. This FREE Indicator Can Transform Your Trading! Request Indicator. Asian session forex Systems Strategies Analysis Signals Autotrading Testimonials Special Offer New!!!

SIMPLE FOREX TRADING - STUDYING THE ASIAN RANGE

, time: 34:37The forex 3-session system

3/11/ · What are the Tokyo forex market hours? The Asian forex session starts off the trading week on a Monday morning at and closes at in Japanese Standard Time (JST).Estimated Reading Time: 6 mins am - am. Market 24h Clock shows the Asian session as a block of lighten up in orange color trading hours for following Stock Exchanges - JPX Tokyo, SGX Singapore, SSE Shanghai, HKEX Hong Kong, and NSE Mumbai. The first major Asian market to open is Tokyo. Tokyo has the largest market share, and is the third largest Forex trading centre So, the Asian session does not necessarily begin and end with the opening and closing of Tokyo as a center. Let us provide some key features regarding trade during the Asian session. the session begins at GMT and lasts until GMT on the next day, or from EDT to EDT during the summer period and from EST to EST during the winter period

No comments:

Post a Comment